Welcome to our market snapshot, where we take a quick dip into the analysis and back and forth that shapes our weekly members’ webinars.

The collapse of Silicon Valley Bank has sent tech investors and startups into a spin, particularly in the US. But how has it affected the bigger picture? This week we look at the price trends taking shape in the FX, Gold and Silver markets, and why I’m planning a long approach to equities for the next two months.

Shape of things to come

I said last week that March was going to be a month of change for the markets — although I must admit I didn’t see a bank failure in the tea leaves.

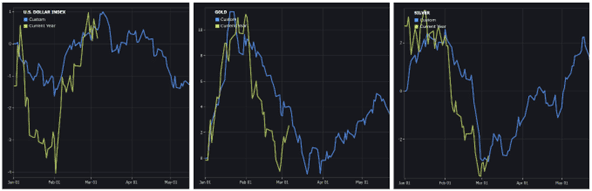

The major indices now look to have completed their existing patterns, and USDX, Gold and Silver are already displaying new trends that resemble the expected price movements calculated by our True Path platform, shown below.

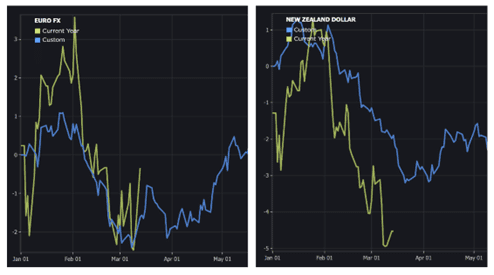

Taking a closer glance at the EUR and NZD markets and the same picture emerges:

With signs the markets are aligning with these predicted paths, it’s tempting to put faith in the future and pile on. However, it is very early days for these new trends so you can expect plenty of price volatility until we get agreement.

Peaks and valleys

This weekend in 2008, collapsed US investment bank Bear Stearns found its white knight in JP Morgan. Fifteen years on and Bear’s saviour, now JP Morgan Chase, is eyeing another rescue move — this time for the Silicon Valley Bank’s holding company, SVB Financial Group.

The Bear Stearns fire-sale deal was seen as a bullish event at the time and prompted a market rally over the next couple of months, but it didn’t last.

So what about this time round?

My plan for the next few months has not changed. I expect to see some short-term price weakness but my bias is firmly on the long side and I’ll be looking for a bullish move for the next couple of months. After that things could well get sticky again, with the realisation that the Fed pausing/cutting rates might not be such a good thing after all.

Last week I said my preferred move would be to see one last move down for the S&P, Dow and Nasdaq, falling below at 4,035, 33,300, and 12,260 respectively. This came to pass and we got some great short trades. Going forward the S&P could still test the 3,800 area before recovering, but I am looking to be long. If you would prefer a safer, less aggressive area to be long, wait for the price to break back above 3,975.

Cutting a long story short

My bullish view of USDX has finally reached its end. One leg higher was my plan for last week, and while it did see a new high, this only lasted until Wednesday before the walls came tumbling down. It’s already fallen below the monthly pivot at 103.60 and so my bias has switched to short.

While I was hoping for one final hurrah from the greenback, I was also looking for a last show of weakness from the Euro. Again, this did occur before a big bounceback at the end of the week. I’m bullish now but mindful of a little bit of turbulence and retracements on the way up so I may have to be patient for longs.

It’s been an interesting few days in the crypto space but my plan hasn’t changed and I continued to be a buyer last week, even before all the weekend fun kicked off.

If we get a retracement towards 23,000 I will buy again, if not it will be above 25,500 on a breakout.