Welcome to our market snapshot, where we deliver a tempting trailer of the discussions and analysis we share with members.

With spring in the air, this week we’ll explore if we’re ready for a big move in the markets, and whether the S&P and Dow can maintain their recent momentum.

Time to steal a March?

The Ides of March is fast approaching and, while I’m not quite predicting a Roman uprising, I expect this month to throw up significant shifts in trends across stocks, commodities, bonds and currencies.

However, I need figures to back this up, especially given the absence of the latest Commitment of Traders’ data.

Fortunately, by looking at some specific market movements, in tandem with historical trends, I’m able to see how they align with the expected direction of travel, indicating change is afoot.

Last month I shared two possible scenarios for the S&P 500, using our True Path platform. Both showed a clear uptrend in late March but the more likely, option A, showed weakness in February that continued into this month before the start of a rally.

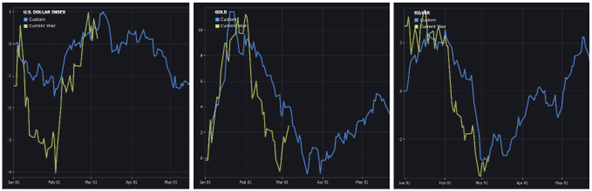

Having seen this play out in equities over the last few weeks, we’ve now let our algorithm loose on other markets, and it’s showing similarities in a number of currencies as well as gold and silver.

Below you can see the current path of the USDX, gold and silver markets, and their expected future trajectory based on current price movement. The good news is that all suggest we are in the window for changes.

It might be that the tectonic plates are already shifting, but I think existing trends could hold sway for another week or two before we see a big move towards the end of the month.

Either way I will be watching price action across the board for confirmation of a change, but I don’t see it just yet.

Small caps don’t fit with positive mood

A bullish end to last week saw strong upsides for the S&P and Dow, which stopped all shorts. If the prices remain above 4,035 and 33,300 respectively then the bias will switch to long, but I’m unconvinced and urge caution on the buy side.

Despite strength in the advance/decline line, the Russell 2000 index has again rejected 1,920 and is moving lower. When small caps are not part of a rally we are definitely in flash-in-the-pan territory.

My preferred move would be to see prices move lower one last time and for the S&P and Dow to retest their lower support levels at 3,900 and 32,330.

One last greenback hurrah

I feel my days of being long on USDX will soon be coming to an end but I think there’s a scope for the dollar to go one leg higher before it rolls over.

Last week it tried — and failed — to hold below 104.30, so my long bias remains in place for now. The monthly pivot and support is around 103.60, drop below that and I will become bearish.

With the dollar set for a reversal into weakness, strength in the EURUSD index is not impossible and I’m ready to go long if it breaks above 1.0700. However, price action remains corrective so I will be looking for shorts if selling kicks in at this level.