Welcome to our weekly market snapshot, a foretaste of the free-flowing conversation and market analysis that take place at our members’ webinars each week.

Another day, another bank rescue, but as UBS prepares to take the reins at its former rival Credit Suisse, what else is making the markets tick? This week we focus on how equities are shaping up — with a particular eye on the Nasdaq — and why its bond strength is dragging gold into bullish territory.

Robust tech edging Nasdaq to milestone

Last week I was keen to be long and some equities, particularly tech stocks, really stepped up to the plate. The Nasdaq 100 in particular enjoyed some impressive gains, and is now closing in on 13,000. This is a significant level for the index and breaking through would be a very bullish development.

Meanwhile the S&P 500 and Dow both stayed largely unchanged. The safe haven for longs in the S&P was above 3,975, but price action wasn’t strong enough to sustain it there so it again broke lower. It has now returned but these displays of weakness can leave some scar tissue, so we will need to clear 4,000 to be confident of longs. For the Dow, 32,600 is our watermark for longs.

Wednesday’s Federal Reserve interest rate announcement is likely to herald a volatile session, and I may look for some intra-day shorts on weakness. Generally however, my bullish bias remains and I am expecting any weakness to be short-lived.

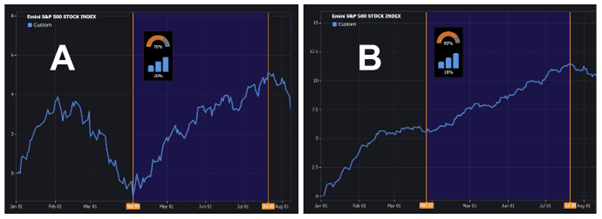

Looking further ahead, our True Path forecast, below, indicates that the S&P is likely to enjoy a sustained upward trend in the months to come.

Calculated back in January, Path A has proved a remarkably good guide to the direction of travel, while both models suggest the current downtrend is almost over. While changes are already beginning to play out in metals and forex, these new trends should be around for several months — so there’s no need to be aggressive in these early stages.

The golden bullet

Just as we saw in 2018 when gold went on its last major tear, it is once again bond strength that is forcing the precious metal higher. Now, as back then, there is little appetite for buying the metal directly, but safety-minded investors are piling into gold bolds.

With this in mind, pay close attention to how tomorrow’s bond yields react to tomorrow’s Federal Open Market Committee meeting and a likely interest rate rise. This will give plenty of clues as to whether gold can go higher still.

Intra-day trades are my clear preference here, with larger daily retracements not expected and uncommon for this type of movement.

Crypto mountains left to conquer

We have finally broken the 25,500 level for bitcoin, which feels like an important hurdle cleared for those of a bullish disposition. Retracements continue to be very shallow and having established a solid base it’s time to look up to the next peak.

One negative is that positioning is not bullish as we break this level — in fact, given how Bitcoin futures have increased, it’s surprisingly very similar to what we got at the last halving low in 2018.

Despite this slight concern, I’m still targeting a move up to around 40,000 by May. You can’t expect plain sailing with crypto, but it will take more than a few bumps to change my long bias.