Welcome to our market snapshot, where we offer you a taste of some of the discussions we have regularly with our members.

This week we weigh in on the latest movements in the S&P 500, FX and Bitcoin markets.

‘Sliding Doors’ moment for equities

Last time I stated that I still see the S&P 500 moving higher but that there could be a pause or some weakness on show before a strong performance in Q2.

Currently, it feels like a real sliding doors moment, where the index may hit 4,200 or break down to 3,800 before the end of March.

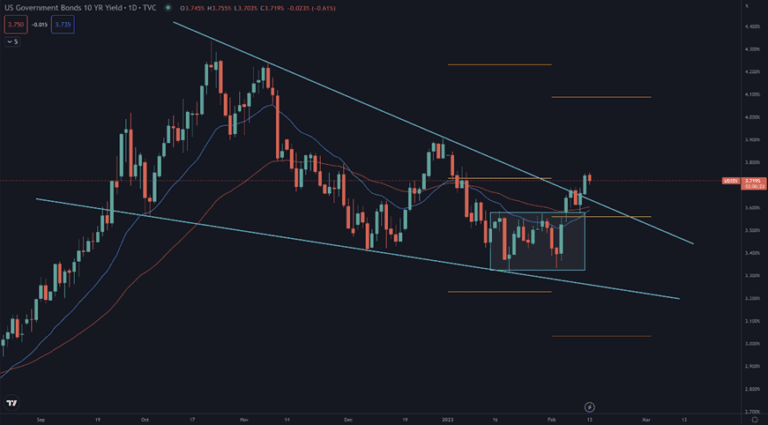

Below, our new seasonal platform — using its True Path feature — illustrates two possible scenarios that could unfold in the months ahead.

Note that in both cases the algorithms show April to July as being the best period and that the paths offer a similar return.

Last week I said I would be watching some big stocks following recent breakouts/gaps higher, to see if they stuck. In most cases, these giants slipped back, with Google and Amazon showing particularly weak price action. By contrast, Apple is holding up well so far but is yet to break from its earnings range to confirm its next direction of travel.

Playing the yield

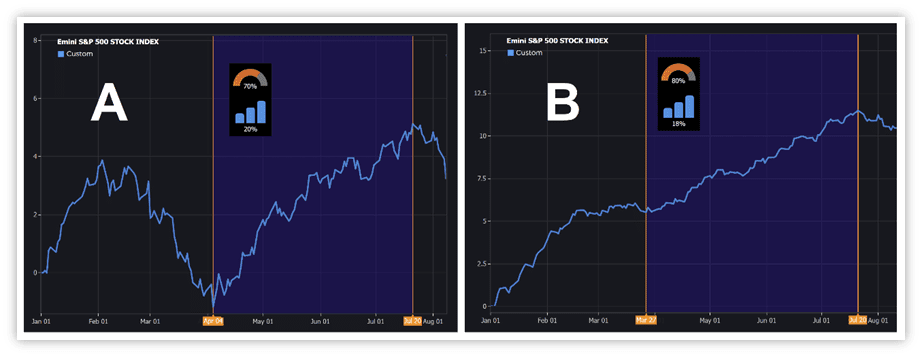

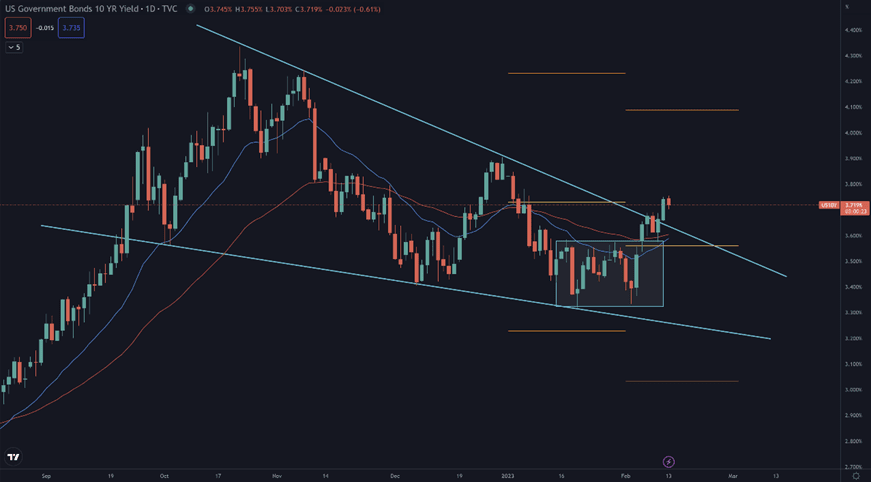

My recent FX strategy has concentrated on being long USD, with one of the main drivers being the recent breakout higher in yields, which should take the greenback higher and push other major currencies lower against it.

Dollar momentum has stalled but yields have continued to move higher as the below chart shows. Again I am looking for USD to catch up, with my focus on the exchange against the euro and Japanese yen in particular.

While we have seen recent strength, the US Dollar Index has still to confirm this strength by breaking through 104. Until this happens be cautious with USD longs.

When it comes to the performance of the EUR, I am looking only at shorts, with a move below 1.0650 the level to confirm this bias. My plan B is if a breakout above 1.0950 is matched by the S&P going above 4,200. In this case, I’m ready to switch my bearish view and consider longs.

For USD/JPY, I am leaning towards long and using yields as my guide. While last Monday’s daily high of 132.90 did not spark the move I was hoping for, with the price again attempting to break higher this week, that same level remains my yardstick.

Given the ongoing delay in positioning data from the Commodity Futures Trading Commission, I feel slightly blind looking at the Bitcoin chart. However, I expect the current weakness to be short-lived, with buyers taking charge soon and a rush towards 25,000.

I won’t set a target for this phase of the cycle until it breaks above 25,300, but as a rough estimate, we should be near the 45-50k level by the summer.

Get in touch with us today to learn more about our forex trading training courses.