This time we’re running the rule over the FX and equities markets, starting with the S&P 500. This time last week I discussed the weak price action we’d been seeing in the S&P 500. I felt the retracement would be a slight slide back towards 4,000 before continuing higher into Wednesday’s Federal Reserve interest rate decision. And so it proved, with the index rising through to Thursday before the inevitable post-Fed hangover kicked in.

My view is that the index will go higher still as we build on the late January trading sweetspot typically seen in pre-election years.

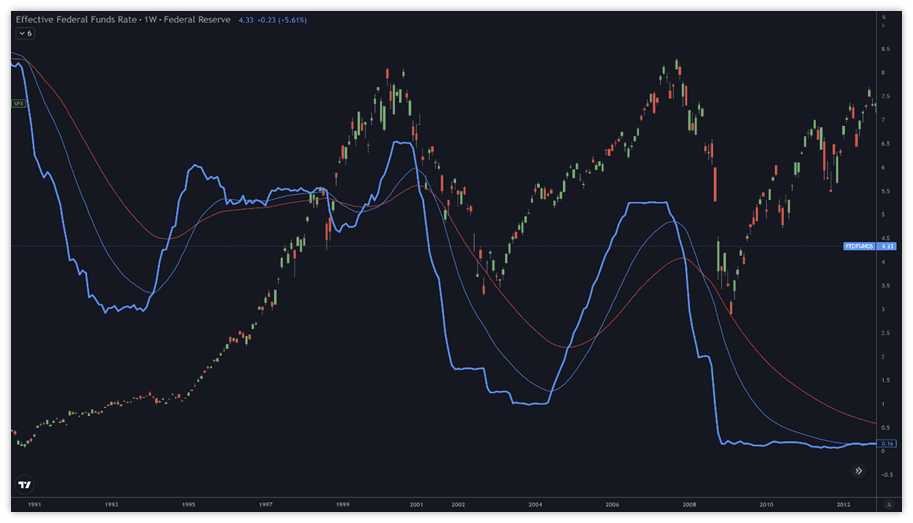

Below you can see the last two major rate cycles in the US. When the Fed holds fire on hiking rates this pause period typically sees big stock gains — it’s when cutting starts that problems arise.

So, while earnings have not been great, expect traders to focus more on the nearer-term prospects offered by a Fed pause, and worry about recessions later in the year.

For exhibit B, take a look below at the annual pattern for the S&P 500 when it has had a strong January:

Price momentum can ease through February and March, but typically we continue higher, with the period from April to July often seeing strong gains.

Yet it might not be completely plain sailing from here. The chart below shows the pattern of two pre-election years where a strong January has been followed by weakness in February.

Key for me, however, is that even where the January growth is not backed up, April to July is still the best period to be long. While the limited sample size means weakness is not impossible, it certainly seems less likely.

Apple has my eye

One chart I’m watching closely is Apple. Last week’s earnings were poor, but they still delivered a jump higher to mirror the previous uptick seen in October. Price action continues to follow, which would indicate we go lower tomorrow. If so, then I think we could see a few more days of selling here.

I’ll be watching the other big names also, to see if they can shrug off poor earnings. They have been retracing following big moves up last week but if gap support holds, buyers will return and the bullish bias for equities will remain. If not, failed breakouts will be confirmed and point to the prospect of a bearish February, at least to start with.

FX views

Regulars will know I have recently been looking to be short on EUR and GBP while also expecting JPY weakness to kick in again. Yet I have also had to bide my time, as February

was always likely to be an easier time for these trades to take place.

Historically, 3 February is the time for USDX to show a reversal higher and that’s exactly what we got last week. Long against EUR, GBP and JPY are my current preferences, with

gold shorts also on that list.

After patiently waiting for EUR to align with my view of the EUR/USD market, I have been aggressive with my trading to try and take maximum advantage. I have been selling the single currency since Thursday and will look to continue, but with less urgency now the initial reversal has taken place and we sit on support around the 1.0650 mark.

I hope that’s given you a flavour of what’s happening in the markets. You’ll find more detailed coverage on our weekly webinar and member newsletter. Click here if you’d like to join us.