Welcome to our weekly market snapshot, where we serve up a taster of the in-depth analysis and debates we share with our members during our regular Monday night webinars.

This week, we’re predicting the next move in the equities markets and looking at how the land of the rising sun — but falling currency — is making for a lucrative FX play.

Be smarter than your average bear

If you go down to the woods today — or failing that, the markets — there’s a bearish bias in the air.

We’re entering a traditionally subdued period, with the next three weeks (from now until March 13) performing negatively in 16 out of the last 20 years. Yet before you start dusting off your picnic basket, it’s important to recognise the conditions for moving over to the downside.

Last week’s spike in the run-up to the US Consumer Price Index data was to be expected but despite tech stocks performing higher through to Wednesday, I never saw the rally lasting the course.

Yields were again my lodestar; as they drove higher, equities were bound to eventually dip as the pressure to sell grew.

However, there is still significant backing for many of the major US indices and these will have to be broken before confirming an all out bearish bias. Keep your eyes peeled for the Dow breaching 33,550, the Nasdaq 12,260 and the Russell 1,920 — as well as waning support on the S&P at 4,060. Should these levels be met, I will be putting my paws in the game and going short.

FX views – Patience pays off for USD/JPY pair

I have been tipping the dollar to make a dash for some time, following the uptick in yields and amid its strengthening against other major currencies. On the other side of the coin I also believed some of the recent resilience shown by the yen was likely to prove temporary and it was due to experience a slide.

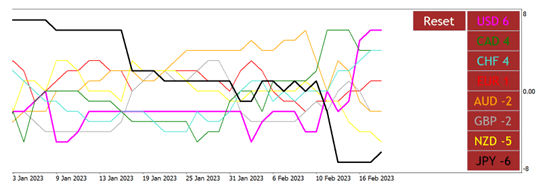

As the below chart shows, last week these predictions were realised with USD swinging upwards while JPY displayed weakness across the board, making it a profitable catch.

Looking at the USDX, here I am bullish. I have tended to favour the long side and last week’s yield increases saw it break through 103.80 to confirm that view. The dollar’s strength could turn out to be short-lived, with many major currencies showing weekly retracements. Yet I think there’s still room for the greenback to move higher, so as long as it can hold above 102.50.

Many FX followers are trading blind at the moment but the cavalry is on the way, with the Commitments of Traders’ data due to finally return this Friday having been put on hold at the start of the month.

When it comes to the EURUSD, my instinct is to be bearish but price action is not helping moves on the short side. I will remain a seller until the price can break above 1.0800 and use the strong correlation with equities to judge the direction of travel. If equity sellers gain some control I will look for new Euro shorts.

I am also looking to go short on GBPUSD, with the monthly pivot at 1.2200 the first place I said I would look for last week. Support at 1.1950 was an issue — and still is — so I will be looking for this to break before any new shorts are considered.

Chomping at the Bit

Bitcoin pushed to 25,000 last week as expected, and I believe this level will soon be broken as the current bull run shows little sign of abating. My third long entry of this rally will be a break above and I’m targeting a push to 40-45k with a high due around May or June.

Get in touch with us today to learn more about our forex trading training courses.